China has occupied the minds of academic economists, political scientists and technocrats for more than 40 years. The country's unprecedented leap from pervasive poverty to the second largest country in the world by GDP, with impressive successes in everything from space to energy and information technology. China is a unique case. Perhaps it is difficult to find a more weighty and powerful factor in the revival of the attractiveness of authoritarianism, the communist state plan and the all-encompassing State.

The Chinese miracle, the Chinese phenomenon, the Chinese challenge to the West - all this has taken an empty place in the worldview / politics of more than a hundred developing countries after the collapse and deafening defeat of the Soviet empire. Since the early 1990s, the VIP stewards of the alien and their ideologues have been chaotically looking for a new benchmark for socialists, collectivists and Big State fans. Russia, with its banditry, lies, theft and barbarism, clearly did not fit. With a meager economy of ~1% of the world's GDP, the lion's share of which is a large gas station, it is impossible to become an example. India, although a democracy, is deeply entrenched in the rut of caste bureaucracy and the all-pervading visible hand of the State. Argentina also did not boast fast, long-term economic growth, although it worked closely with the IMF for decades.

China has changed country benchmarks and adopted an entrepreneurial growth model (spotted)

Chinese party bosses, along with commercial favorites, decided to take advantage of a unique historical chance to take the place of the second pole of power and wealth in the world. The path to achieving this strategic goal lay not through collective farms and the State Planning Commission, but through SEZs and the emancipation of micro and small businesses throughout the country. The Chinese communists, under the red banners of Marx-Lenin-Mao, treated their country to a fair dose of economic freedom. Of course, there was no talk of any political freedom or civil pluralism. A critical mass of those who wanted the luxurious life of the world's business elite has accumulated in the Chinese leadership. Strict modest tunic and boots of the era of the Cultural Revolution, stained with the blood of compatriots, plunged the country into poverty and chaos. Terrible repression, coupled with an all-encompassing state plan, has confidently turned China into a territory of ignorance, poverty and weakness. In the late 1970s, almost 80-year-old Deng Xiaoping and his team breathed fresh, young blood into a completely disassembled country.

In the early 1980s, China's GDP per capita was less than $300, and the entire economy was under $300 billion. A very low start for an Asian giant that the Communist Party reduced to the status of an economic dwarf. The Chinese comrades, having eaten their fill of crude Marxism and Leninist savagery, decided to try what was under their noses. Hong Kong and Singapore are the same Chinese, but they lived in a completely different way. In 1981 Hong Kong's per capita GDP was $5,995, 20.8 times that of China. In 1991 GDP this figure was $15298, 42.9 times more than in China. The same situation was in Singapore. Its GDP per capita in 1981 was was $5672 (19.7 times more than in China), in 1991. - $14502 (40.6 times more). Hong Kong/Singapore chose capitalism and the free market, which China did not have.

Party leaders realized that it was possible to maintain control over political institutions and at the same time allow ordinary Chinese to provide for their own survival. For the most enterprising, they began to create free economic zones with a regime for laissez-faire producers. We started with four. Then fourteen more were added. In the 1990s, 15 additional free trade zones, 32 economic and technological development zones, and 53 new high-tech industrial development zones were opened. These economic freedom zones worked according to the patterns of Hong Kong / Singapore, and not the regulated countries of the EU or the USA. Hence the rapid economic growth.

Once again, it is worth emphasizing that the Chinese Communists did not begin to fence another state plan with the total control of the Official. They have adopted a model that works and is guaranteed to bring great results. This is the Mises/Schumpeter model of entrepreneurial growth. I doubt that the Chinese VIP alien stewards have studied the works of these great scientists. They just changed their direction. Before that, China was guided by the Soviet Union, but its model was distinguished by particular cruelty and Stalinist suffocating frenzy. In the 1980s, the Hong Kong/Singapore model became such a benchmark. The Chinese communists understood more than 40 years ago that the only road to material well-being was capitalism, with its economic freedom and private property. Consider: Hong Kong and Singapore, by adopting this system and entrepreneurial growth model, in the early 1980s were richer than Ukraine in the early 2020s. It is especially depressing that the Chinese communists at the top of power 40 years ago understood economic policy more than the VIP-managers of a foreign Ukraine. The team of 80-year-old Deng Xiaoping was focused on the country, on national revival, on the future, and many Ukrainian top decision makers aged 40+ continue to work for their own pocket, schematosis within the framework of a toxic state planning a la Soviet paradigm.

Creating an economic miracle is not a short-term, tactical project of one political group. This is a long-term (at least 20 years), strategic story based on the consensus of key policymakers and disposition makers with the support of power structures and social influencers. At the same time, the motivation of the beneficiaries from systemic reforms should be clearly and boldly expressed. The benefit for the Chinese reformers was obvious - the creation of a powerful material base for the revival of China. Benefits for enterprising Chinese were also on the surface - to become rich and successful. Benefits for ordinary Chinese people, who were hit by the bloody rink of the Cultural Revolution, dramatically increased the chances of surviving and escaping from the zone of chronic hunger. Nomenclature,

Let us note several features of China's economic development in the first 20 years of reforms. First, in the early 1980s, China reduced the relatively low level of government spending at ~23-25% of GDP even more, to ~15% of GDP. This is the regime of a small state. It is clear that the Chinese Communists controlled the lion's share of resources and assets, but they listened to the opinion of those economists who recommended the optimal size of the state, as the amount of resources redistributed through all state administration bodies. In the 1980s and 1990s, this was about the same in Hong Kong (in 1981 government spending was 17.1% of GDP, in 1991 - 12.8% of GDP, in 2001 - 18.4% of GDP) and Singapore (in 1981 - 17.1% of GDP). government spending accounted for 15.5%, 15.9% and 18.2% of GDP, respectively). In Taiwan, there were more, but not at the level of highly socialized countries in Europe: in 1981. - 25.4%, in 1991 - 30.2% and in 2001. - 24.3% of GDP. Note that in the next 20 years, Taiwan's government spending has never exceeded 23% of GDP, and since 2013. was less than 20% of GDP. Taiwan made a bet on capitalism and the free market much earlier than China. Therefore, in 1981 its GDP per capita was $2,691, 9.3 times that of China. In 1991 Taiwan's GDP per capita was $9,082, 25.5 times that of China. Such successes of rival neighbors could not but affect the leadership of China, because the successful countries of Asia, among other things, won the regional struggle for human capital and foreign investment. In addition, they were a place of flight for enterprising, talented Chinese who did not want to walk in formation all their lives and eat the standard stew according to a recipe approved by the Communist Party. was less than 20% of GDP. Taiwan made a bet on capitalism and the free market much earlier than China. Therefore, in 1981 its GDP per capita was $2,691, 9.3 times that of China. In 1991 Taiwan's GDP per capita was $9,082, 25.5 times that of China. Such successes of rival neighbors could not but affect the leadership of China, because the successful countries of Asia, among other things, won the regional struggle for human capital and foreign investment. In addition, they were a place of flight for enterprising, talented Chinese who did not want to walk in formation all their lives and eat the standard stew according to a recipe approved by the Communist Party. was less than 20% of GDP. Taiwan made a bet on capitalism and the free market much earlier than China. Therefore, in 1981 its GDP per capita was $2,691, 9.3 times that of China. In 1991 Taiwan's GDP per capita was $9,082, 25.5 times that of China. Such successes of rival neighbors could not but affect the leadership of China, because the successful countries of Asia, among other things, won the regional struggle for human capital and foreign investment. In addition, they were a place of flight for enterprising, talented Chinese who did not want to walk in formation all their lives and eat the standard stew according to a recipe approved by the Communist Party. Taiwan's GDP per capita was $9,082, 25.5 times that of China. Such successes of rival neighbors could not but affect the leadership of China, because the successful countries of Asia, among other things, won the regional struggle for human capital and foreign investment. In addition, they were a place of flight for enterprising, talented Chinese who did not want to walk in formation all their lives and eat the standard stew according to a recipe approved by the Communist Party. Taiwan's GDP per capita was $9,082, 25.5 times that of China. Such successes of rival neighbors could not but affect the leadership of China, because the successful countries of Asia, among other things, won the regional struggle for human capital and foreign investment. In addition, they were a place of flight for enterprising, talented Chinese who did not want to walk in formation all their lives and eat the standard stew according to a recipe approved by the Communist Party.

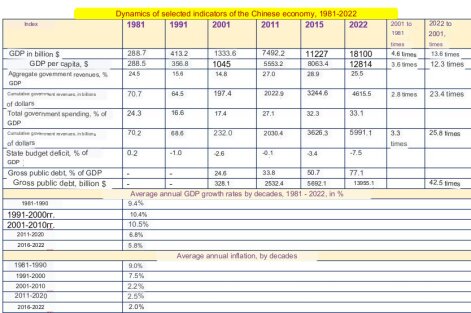

The average annual pace in the first 20 years of reforms amounted to almost 10% of GDP. After a sharp increase in the level of economic freedom in the special economic zones, allowing the villagers to freely cultivate the land and feed themselves, it was not difficult to ensure such growth. Let us note two very important parameters of China's economic policy during the first 20 years of reforms. First, China did not allow a slide into hyperinflation, but managed to bring inflation under control. True, by the standards of classical price stability, it was high (an average of 9% in 1981-1990 and 7.5% in the period 1991-2000). Secondly, public administration expenditures were kept at a very low level (on average 15-17% of GDP over the first 20 years of reforms). The Chinese comrades understood the value and significance of macroeconomic stability. From the early 2000s to 2023 average annual inflation slightly exceeded 2% per annum. But in the field of fiscal policy, events took place, trends developed that drove China of the 2023 model into a very difficult position.

If in 1981-2001. China's GDP in $-dollars increased by 4.6 times, and the costs of government bodies over this period increased in dollars by 3.3 times. That is, the Chinese authorities behaved in a disciplined and relatively responsible manner. The principle was “earn first, and then distribute part”. Recall a simple rule of fiscal policy. With low taxes, the economy grows, which expands the tax base and increases budget revenues. In 1991 China's total government spending amounted to only 16.6% of GDP, or $68.6 billion. government spending practically remained at the same level, amounting to 17.4% of GDP, but this has already given the state $232 billion, i.e. 3.4 times more. This is just about the critical importance of prioritization or about the fact that first the horse and then the cart. First poor, developing, a transitive country should create conditions for rapid, long-term economic growth, and then only think about increasing the share of government spending in GDP. This is a valuable lesson from China in its first 20 years of reform. In the period 2001-2022. China has broken this golden rule of healthy economic growth. GDP in dollar terms over this period increased by 13.6 times, but government spending - by 25.8 times. The IMF does not provide statistics on China's public debt in the period 1981-2001. But in the period 2001-2022. public debt in dollar terms increased by 42.5 times, exceeding 77% of GDP. For a country with a below average per capita income, this is a very dangerous level of debt. China has broken this golden rule of healthy economic growth. GDP in dollar terms over this period increased by 13.6 times, but government spending - by 25.8 times. The IMF does not provide statistics on China's public debt in the period 1981-2001. But in the period 2001-2022. public debt in dollar terms increased by 42.5 times, exceeding 77% of GDP. For a country with a below average per capita income, this is a very dangerous level of debt. China has broken this golden rule of healthy economic growth. GDP in dollar terms over this period increased by 13.6 times, but government spending - by 25.8 times. The IMF does not provide statistics on China's public debt in the period 1981-2001. But in the period 2001-2022. public debt in dollar terms increased by 42.5 times, exceeding 77% of GDP. For a country with a below average per capita income, this is a very dangerous level of debt.

Let us note one more very important aspect in carrying out deep market reforms. This is the time to build the confidence of internal and external investors in government policy, as well as the time to create high-quality entrepreneurial capital for the implementation of long-term commercial projects. In the first decade of reform, China saw rapid growth in basic liberalization and commercialization of small assets. In the second decade, the Chinese diaspora from abroad began to actively catch up. They accounted for the lion's share of foreign investment. Only in the third decade of economic reforms did international transnational companies come to the country, seeing the possibilities of profitable outsourcing and the growing capacity of the domestic market. It was in the 2000s that the mechanisms of self-criticism and self-destruction of the Chinese economy were laid.

Not tens of billions, but trillions of dollars ended up in the hands of VIP-stewards of someone else's. In 2008 For the first time, China's government budget exceeded $1 trillion. In 2022 it came close to the $14 trillion mark. The dizziness of success killed fiscal caution, eclipsed the basic factors of healthy economic growth. The axioms of economics were sent to the scrap.

Powerful syndicates/clans of VIP managers and consumers of foreign goods have formed in China. At the central and local levels, in various sectors of the economy, in finance, construction, industrial production and trade. Party and power bosses could not and did not want to put up with how dozens, if not hundreds of billionaires appeared in the country before their eyes, how economic power began to get out of control, how the middle class became more and more massive, which clearly did not feel communist soldier.

Since the 2000s, the Investor State, the State Manager and the State Businessman have become more active. R. Lam and M. Badia (W. Raphael Lam, Marialuz Moreno-Badia) wrote about how fiscal policy changed in great detail and qualitatively in their work “Fiscal Policy and the Government Balance Sheet in China” https://www.imf.org/en/Publications/WP/Issues/2023/08/02/Fiscal-Policy-and-the-Government-Balance-Sheet-in-China-536273 It was published on the IMF website on August 4 2023

State Enterprise Sector and Public Budget of China

To understand the current state of China, let's look at history. At the very beginning of market reforms in China (late 1970s), state-owned enterprises (SOEs) accounted for 78% of industrial revenue and 75% of urban employment. In the beginning, state-owned enterprises were given more autonomy, gradually removing barriers to entry for private companies. Since 1985 state-owned banks began lending to state-owned enterprises, reducing state budget expenditures for these purposes. At this stage, subsidies for SOEs did not decrease, their profitability did not increase, because they began to operate in competition with the private sector. Their monopoly was broken. In order to avoid the closure of plants and factories, the government ordered state-owned banks to provide support to unprofitable SOEs. As a result, inflation soared as the central bank printed money to hand over to state banks.

By the second half of the 1990s, more than 2/3 of SOEs were unprofitable. This is an argument for those in Ukraine who still believe that the form of ownership does not matter, that the main thing is the quality of management. The average return on capital was minus 4%. Under considerable financial pressure, some local authorities began privatization without waiting for permission from the central government. Reforms proceeded very slowly. There were few bankruptcies because the SOE sector made the entire economy hostage to its activities.

In 1994 there was a fundamental change in the redistribution of fiscal revenues and expenditures between the central and local authorities. New bankruptcy legislation was passed to speed up the restructuring process. In 1995 the central government reformulated the reform strategy based on the principle of "take big, leave little". Large SOEs were consolidated into large holdings in several strategic sectors of the industry, which remained under state control. At the same time, the privatization or liquidation of small enterprises was launched. In 1997 there were 262 thousand SOEs in China. Ten years later there were 116,000 left. At the same time, the process of creating new state-owned enterprises was going on. In 2003

The Chinese communists, not out of love for the free market, decided on deep reforms. By the mid-1990s, the huge losses of SOEs burdened the banking sector with bad, non-performing loans (NPLs). To strengthen the financial system, development banks (policy banks) were created. They were released from their obligation to subsidize SOEs. at the first stage, they were also forced to maintain unprofitable SOEs, which slowed down their work.

The authorities began to solve the problem of bad debts in the banking sector with four large banks. The recapitalization and cleanup of bad loans (NPLs) dragged on for nearly a decade. Gradually, the banking sector was liberalized, and the share of private and foreign capital was increased.

By 2007 the public sector has completed its structural transformation. Between 1998 and 2007 more than 2/3 of operating industrial enterprises were privatized or liquidated. The share of SOEs in value-added production has fallen by more than half. More than 30 million workers were laid off. As a result, the share of employment in SOEs among the urban population has fallen to less than 15%. Unemployment rose sharply. Labor productivity in the remaining SOEs has converged with the private sector. To a large extent, this was ensured due to the preservation of a monopoly position in capital-intensive sectors of industry and access to concessional lending by state banks.

State banks and their perverse links with the real economy and government

As of 1997 the net worth of China's four largest banks was only 3% of assets. By 2007 the situation has improved significantly. Banks have been cleared of bad loans. The government spent a lot of money on this. By the end of the 2010s, the share of bad loans was only 1.1%. This was the result of the transfer of bad loans to asset management companies and a tighter approach to lending. Despite the IPOs of state-owned banks, most of the banking sector remains state-owned. It also provides service to SOEs (customer base) through them.

The restructuring of state-owned enterprises and banks was accompanied by a proactive fiscal policy, which led to a deterioration in the state of public finances. The government launched fiscal stimulus in 1998 during the Asian crisis. Over the next five years, the government continued to pursue a countercyclical fiscal policy to support the financial sector and SOEs reforms. Among the measures taken were write-offs of bad assets/debts, transfer of bad debts/assets to asset management companies for a symbolic price, monetary support from the central bank. During this period, the state budget deficit and public debt changed little, because the measures taken were not reflected in the budget statistics.

From 1997 to 2002 total government spending in China grew by 5.7% of GDP, while the primary budget deficit increased by only 0.5 percentage points, public debt - by only 4% of GDP over the decade (1997-2006). If we take into account off-budget operations, the debt increased by 8.5% of GDP. By the end of the 1990s, bad assets accounted for ~30% of the nominal share price. The cost of state-owned enterprises in 2000 was 11% of GDP, about a third less than in 1997. After the restructuring, cleaning the balance sheets of bad assets and debts by 2007. the state's share increased to 39% of GDP.

The Chinese authorities have spent a lot of money on the restructuring of state-owned banks. In 2002 cumulative losses of state-owned banks exceeded 10% of GDP. The government made an injection of capital into the six largest commercial banks. Overall, the restructuring cost was 11% of China's 2005 GDP, excluding central bank intervention. At the same time, the official public debt rose slightly, because these were the operations of the central bank and government agencies.

By the end of 2007 state-owned banks were partially privatized and entered the IPO. The government announced another massive fiscal stimulus at the very beginning of the 2008 crisis. The package of measures amounted to ~11% of GDP. The money had to be spent before 2010 to avoid a deepening recession. Half of the finances of this package of measures were directed to public infrastructure projects, a quarter - to repairs and maintenance. At the same time, monetary policy was eased, which led to a significant credit expansion. State-owned enterprises received much more resources than private ones, which reversed the trend of the previous decade.

This stimulus package was implemented not only at the expense of the resources of the central government. Local authorities have played a significant role. They took out loans, issued municipal bonds, stepped up gray banking operations. Local authorities easily circumvented the ban on borrowing through a special financial platform LGFV (local government financing vehicle). She used the land as collateral for a bank loan. At the same time, local authorities provided guarantees for LGFV lending. As a result, the money went to government projects, and the central government did not have to show the growth of public debt in its reports. Such schematosis - the special relationship of local authorities with LGFVs significantly reduced the level of financial discipline. Taking into account off-balance sheet lending in the period 2008-2013. public debt increased by 21% of GDP.

The calculation was that large infrastructure projects would generate more profit than needed to service loans. In reality, it didn't work out that way. The return on investment was, on average, lower than the cost of servicing loans. During the period 2010-15. the situation worsened.

In about 25% of the provinces, the combined debts of the local government and LGFV exceed 100% of their GDP. About a third of the provinces, mostly on the coast, have a combined debt of less than 50% of their GDP. Those provinces that have relied heavily on public investment for development and growth have the highest levels of debt.

In addition to LGFVs, SOEs also expanded support for the economy in 2008-2013. They were informed of the development goals, including the financing of real estate and infrastructure. Support for the development strategy abroad was also part of the assignment. The expansion did not end well. More than a third of SOEs recorded losses of 1.5% per year. Profitability of provincial SOEs was lower than central ones. In fact, SOEs reforms came to a halt in 2007. In 2013 efforts were made to speed them up, but the creation of new SOEs continued at a rapid pace. By the end of 2015 about 10% of SOEs were zombie companies. Such commercial structures pay less taxes, absorb most of the subsidies, and have better, preferential access to the financial market. They crowd out the healthy

By the end of the 2010s, there were an estimated 217 thousand non-financial state-owned enterprises in China (accurate statistics in China are a big problem). Of these, 96 are central government conglomerates. They are supervised by the State-Owned Assets Supervision and Administration Commission of the State Council (SASAC) or in our State Property. Each of these structures has six, sometimes even more levels of subordinate structures. As a result, these conglomerates unite 62 thousand SOEs. The public sector is also 155,000 local SOEs, not counting LGFVs.

~70% of government stimulus in China went through off-balance sheet instruments. LGFVs are a special category of organizations. National Audit Office in 2014 counted 7170 such LGFVs. Another government agency listed 11,566 LGFVs. Some experts interpret LGFVs as a special type of state enterprise. In 2014 the central government decided to audit LGFVs. As a result, it is in 2014-15. assumed the debts of these organizations, which increased the debt of the central government immediately by 22% of GDP. A debt-for-bonds exchange program was launched in the amount of 25% of GDP in 2015. Debt maturities have been extended, interest rates have been lowered, and local debt instruments have been standardized.

However, these measures were not successful. LGFV with local authorities continued financial, commercial transactions. Since 2014, when the debts were restructured, they continued to increase. By the end of 2018 they reached 34% of GDP.

Faced with the poor performance of the SOEs, the Chinese Communists decided to launch yet another reform of the public sector. It includes:

- change in the status of the state: transition from a manager and operator to an investor of capital; the introduction of different ownership structures, professional management, the distribution of responsibilities between the owners and the board of directors, the introduction of a system of checks and balances;

- the distribution of SOEs into three broad categories and the institutionalization of the leading role of the party in them. Each category has its own specific ownership structure, reform plan and evaluation criteria: 1) strategic SOEs (military, telecom, large energy companies). They will remain in state ownership and will implement national strategies, 2) commercial non-strategic SOEs. They will compete with private market structures, 3) SOEs with social functions. They should improve the quality of public services.

- Solving the problem of unprofitable SOEs, liquidating approximately 350 local branches of central SOEs and approximately 4,000 local level SOEs.

On paper it should have been one thing, but in life it happened not at all. In 2015-19 there was a sharp increase in the presence of the state in the commercial sector. Its share increased to 49% of GDP in 2019, mainly due to the growth of local SOEs. Then the situation was aggravated by COVID. The tension is rising. Youth unemployment is on the rise. The demographics are terrible. Pyramids in the real estate market threaten to collapse. The volume of toxic loans in the banking system requires budgetary mobilization. Government and corporate loans are squeezing the economic growth loop, which is declining markedly. The Communist Party staged a real hunt for big businessmen who entered the world economic elite. The state, like a dog in the manger, threatens to turn into a dragon destroying weakening market institutions. Keep the balance without deep, painful operations to remove toxic blockages of assets/capital is objectively impossible. For too long, too many foreign central and provincial level VIPs have engaged in investment, manufacturing, financial interventionism. Attempts to strengthen the centralized iron hand of the Chinese state plan will inevitably lead to growing points of tension and rupture.

Chinese lessons for Ukraine

Ukraine and China have one common period in their history. It is dysfunctional and bloody, because it is totalitarian and Soviet. I am sure that Ukraine will never return to it. Fortunately, we became independent in 1991. China began to emerge from the witchcraft of Marxist Soviet insanity in the late 1970s. He tried a variety of economic policy instruments. Where China has allowed economic freedom and the institutions of capitalism, it has enjoyed unprecedented economic success. Where he retained control of alien VIPs over resources, assets, and economic institutions, commercial failures, blockages, and crises resulted. Formulate the main Chinese lessons for Ukraine:

1) China's economic success is a direct consequence of the legalization of institutions that ensure economic freedom. Let them be in free economic zones and in special territories. Albeit partially and fragmentally, it was the free market regime that became the foundation of the average annual growth in the period 1981-2021. at 9.3% of GDP. Ukraine has never in its history tried, applied those recipes and solutions that ensured the success of China. It's time.

2) China has failed to ensure the quality management of public resources and assets. VIP-stewards and consumers of other people have become the main source of failures and losses. If China had completed privatization in the 2000s, it would not today be facing the threat of a crisis and the imperative of a deep structural catharsis. Full privatization of the public sector in Ukraine is an absolute must.

3) China has shown the inefficiency and toxicity of the state-investor, the state-determiner of "points of growth", innovative, technological priorities. Such a regime breeds corruption, debt and tension in the financial system. The best investment regime for Ukraine is laissez-faire, i.e. the State guarantees the protection of property rights, macroeconomic stability and a favorable regime of relations with the outside world. Entrepreneurs, private investors, creditors, shareholders, without state interventionism, create the first ever national structure of the Ukrainian economy.

4) Good monetary and fiscal policy is critical. The optimal amount of government spending to ensure rapid, long-term economic growth is up to 20% of GDP. As a monetary regime, it is advisable to use the money that is already trusted throughout the world. In other words, multicurrency is the optimal mode for a sharp, rapid reduction in regulatory and transaction costs.

5) Partnership with international corporations, entry into the country of large foreign business does not guarantee the creation of a favorable business climate for small businesses. It is critically important to carry out deep deregulation, legalization of competition of norms/standards. Risk management should go through private institutions.

6) Decentralization alone does not solve the problem of improving the quality of public administration. On the contrary, local authorities can become a source of fiscal recklessness, accumulation of debts and the creation of dangerous nomenklatura-commercial syndicates at the local level, if they are instructed, obligated and empowered to "stupidly" ensure economic growth. State interventionism is harmful, no matter at what level of government it is practiced.

7) To ensure rapid, long-term, inclusive growth, it is optimal not to turn the country into a patchwork of special zones / territories, but to turn the whole country into a jurisdiction that would be close to Chinese SEZs or Taiwan / Hong Kong / Singapore at the stage of their transformation from poor to prosperous.

Source: IMF Database, https://www.imf.org/en/Publications/WEO/weo-database/2023/April