On May 3, the European Commission is expected to finalize the next, sixth set of EU sanctions against Russia for its actions in Ukraine, which will include a ban on the purchase of Russian oil. In addition to moral and political, there are purely logistical aspects to this issue. Where to get and how to deliver the missing volumes to consumers? Careful planning and coordinated action can meet this challenge.

Oil embargo will deprive Russia of a huge part of export earnings

The EU is close to approving the sixth package of sanctions against the aggressor country. Representatives of the EU member states will provide the new package of anti-Russian sanctions to EU ambassadors for consideration on Wednesday, May 4th. After that, it is planned to introduce restrictions before May 9 to European Comission.

The 6th package of sanctions is likely to include not a Big Bang, but phased oil embargo. Russia’s oil import is planned to be banned step-by-step until the end of the year. It is possible that some exceptions could be made for Hungary and Slovakia, given the current diversification difficulties.

Now the EU pays Russia $700 million for oil and oil products per a day. However, this relationship is not symmetrical. For Europe, the share of Russian oil and oil products is about 25%. But this figure varies by country. But for Russia, the EU market is the key - more than 50% of oil is exported there. Accordingly, if the EU imposes an embargo on the import of Russian oil, the Russian Federation will lose 22-24%.

All already imposed trade sanctions cover only up to 19% of imports from the Russian Federation to the European Union. For comparison, the share of oil and gas in recent years has been about 50–60% of all Russian imports to the EU.

The loss of these revenues is an extremely serious measure that will cause serious damage to the Russian Federation. After all, if the EU imposes an oil embargo on Russia, it will be difficult to find other buyers.

But for the EU it is much easier to replace Russian oil, however its transportation can be a problem only for certain regions. The question is in its timing - there are different assessments, but most experts say that it is quite realistic by the end of 2022.

Russia receives almost half of its budget revenues from the sale of oil and natural gas: about 80% out of which accounts for taxes on oil and petroleum products sale, and 20% for gas sale. In 2022 Q1 , Russia received $35 billion revenue for oil and gas trading taxes, which is $1 billion every three days.

What volume are we talking about? The total embargo is estimated at about 100 million tons of oil per year.

The problem of sulfur and oil pipelines

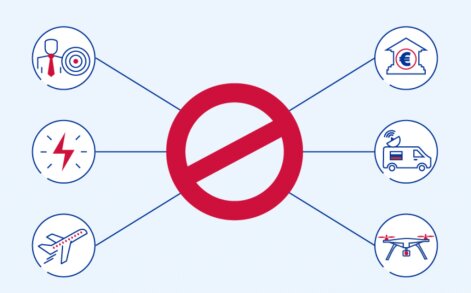

There are two key issues for the EU to substitute Russian oil: supply routes and chemical composition.

As for the delivery routes, there are two of them: by tankers and the Druzhba (Friendship) oil pipeline. The Druzhba pipeline is the world's longest oil pipeline and one of the biggest oil pipeline networks in the world. It carries oil some 4,000 kilometres from the eastern part of European Russia to points in Ukraine, Belarus, Poland, Hungary, Slovakia, the Czech Republic, Austria and Germany.

Obviously, tanker supplies are the easiest to replace.

But the chemical composition is not so simple. The problem is the brand of oil: some of the European refineries are adapted precisely to Russian Urals. Its peculiarity is that it is heavier and contains more sulfur (sulfur content of about 1.3%) than Brent or WTI grades. However, Urals is not unique. A perfectly acceptable alternative to Urals could be oil from Iraq or from the North Sea from Norway.

Separately, it should be noted that Russia has another brand of oil. West Siberian oil (Siberian Light) is also produced, which has an acceptable quality (0.6% sulfur) and is similar in composition to Brent and WTI. So, it can be easily replaced. For example, the shipping division of the French company TotalEnergies has chartered a tanker to ship oil from the United Arab Emirates to Europe in early May. CSSSA chartered the Suezmax Moscow Spirit tanker to ship 1 million barrels of Murban crude oil from the port of Jebel Danna (UAE) for the UK on May 1-3. In the coming months, more oil tankers will be sent from Abu Dhabi to Europe to make up for the shortage of Russian oil.

Replacement will have to be found. Most of the Western oil companies have announced their withdrawal from Russia. In addition, all oilfield services firms have already left Russia. Western insurance companies do not want to insure Russian tankers, port employees do not want to unload them. As a result, this leads to a decrease in production. And in the future, this decline will increase even more - as Western equipment wears out.

Thus, according to the International Energy Agency, in early April, oil production in Russia fell by 700,000 barrels per day. At the same time, the IEA believes that by the end of April the fall could be 1.5 million barrels per day, and from May and on - about 3 million per day.

Germany’s case as a comprehensive approach to the problem of independence

Germany imported 28.1 million tons of oil from Russia in 2021. More than 2/3 came through the Druzhba oil pipeline. Another 1/3 was delivered by tankers.

The key transport routes for the supply of Russian oil by tankers to Europe are the Baltic ports of Ust-Luga and Primorsk. The volume of export transshipment through these ports in 2021 reached 23.5 million tons and 35.8 million tons. The main shipping destinations were Poland, Germany, Italy and the Netherlands. At the same time, over 90% of deliveries fell on Aframax class vessels with a deadweight of 80,000 tons to 120,000 tons. And this part can be replaced relatively easily.

Importers will first have to find suppliers of oil of similar quality (Iraq, Norway). After that, it will be necessary to lay new routes for its delivery, which may turn out to be much longer. The new routes will also be more expensive: tanker charter rates have risen by about 50% since the start of the war. All these problems are now being handled by refineries in West Germany. But this task is quite realistic: it is possible to use oil pipelines connected with the largest oil port in Europe - Rotterdam.

With pipelines situation is more complicated.Druzhba supplied and continues to supply the largest refineries in Poland (Plock), the Czech Republic (Litvinov), Slovakia (Bratislava) and Hungary (Budapest).

in East Germany, at the beginning of 2022, two large refineries were completely dependent on the pipeline - in Schwedt (and the border with Poland). As well as a factory in Leun, southwest of Berlin. They can process up to 21 million tons of oil per year.

In January 2022, about 750,000 barrels of oil were transported west through Druzhba (IHS, 2022) per day. If extrapolated to a year, this would correspond to the amount of 37.5 million tons of crude oil.

The plants in Schwedt and Leuna can consume about 21 million tons of crude oil per year.

The Schwedt plant is operated by Rosneft. It supplies oil products mainly to the capital of Germany - Berlin. It provides jet fuel to the new Berlin airport BER. The Leuna refinery is owned by Total (France) and supplies southern East Germany.

It is interesting that these plants are still not connected in any way with the oil pipeline system of West Germany. It a consequence of the former country division to the FRG and the GDR. That is why there is no physical possibility to supply them with oil from Rotterdam.

That is why the salvation of East Germany's oil refining industry depends on its eastern neighbor, Poland. After all, there is the port of Gdansk, which has large capacities for transshipment of oil.

Here the politicians of both countries helps to refinery. As a result, it was possible to agree with Poland on the import of oil through the port in Gdansk. So now, according to German Vice Chancellor Robert Gabeck, the share of Russian oil imports has dropped from 35% to 12% since the start of the war. And after the agreement with Poland, even a complete stop of oil supplies from Russia no longer promises a disaster for the German economy.

So the German government is ready to deal with possible sabotage of the Russian Federation. And now, if Rosneft refuses to process non-Russian oil at the plant in Schwedt, then the enterprise will be transferred under state control. A similar precedent has already occurred with the German "daughter" of Gazprom.

Thus, interstate cooperation, good neighborly relations and European mutual assistance resolved the problem of East Germany's dependence on Russian oil.

How can Poland, the Baltics and Bulgaria manage without Russian gas?

Bulgaria and Poland abandoned the Kremlin's demand to pay for gas in rubles. Russia is threatening to cut off supplies to these countries. The situation has accelerated the abandonment of Russian gas.

But thanks to timely preparation and diversification, there will be no disaster in these countries either. The multi-year contracts with Gazprom of these countries expired this year anyway. And there are alternatives to Russian gas.

Poland and the EU have been building the Baltic Pipe for several years. This gas pipeline runs from Norway along the bottom of the sea. It will be launched in October 2022. Poland will receive 10 billion cubic meters of gas per year via Baltic Pipe. This number is more than 9.67 billion from Gazprom (2020).

Bulgaria is more dependent, but not less determined. It receives almost 90% of its gas from Russia. But there is also an alternative such as gas from Azerbaijan. Greece-Bulgaria interconnector will be launched soon. And then the country will be able to significantly increase its supplies. In addition to the pipeline, Greece has a floating terminal for liquefied natural gas (LNG), which Bulgaria can also buy. As a result, Bulgaria will not feel the loss of Russian gas at all.

Another example of a pan-European approach to diversification is the 508-kilometer GIPL gas pipeline connecting Lithuania and Poland. It was launched on May 1st. The goal of the project is to strengthen the energy independence of the region. The pipeline will provide access to liquefied natural gas from the floating terminal in Klaipeda, which Poland will also be able to import by tanker. “Now, having the opportunity to import and export gas through GIPL, Lithuania and Poland have increased the energy security not only of their countries, but also of all the Baltic countries and the Finnish region, which is especially important in the context of the current geopolitical conditions,” the company noted.

And again we see that the coordinated actions of the neighbors will make it possible to overcome the racket of Russia.

In general, there will be no rejection of Russian energy raw materials for Europe. The Russian Federation is a large, but by no means the only manufacturer on the planet. So the coordinated EU policy and mutual assistance turns a complex political problem into a real logistical challenge.