With each day of the full-scale war, the difference between the current situation in different regions of Ukraine is becoming clearer. This difference is manifested in the economy, politics and in general in the living opportunities of communities. The rear areas, the frontline zone and the occupied territories de facto exist in parallel realities, and this fact needs to be reflected in the legal plane. Especially since Ukraine has been living with flexible "regional zoning" for the past two years due to the pandemic (although for the current situation, the "region" may be too large a unit of analysis).

In early May, government officials announced a bill that would divide Ukraine into several zones with different economic and political backgrounds for each. As of mid-June, these objectively correct ideas have not been embodied in a specific draft amendment to the legislation. In this article, the Observatory for Democracy think tank presents a view from frontline Kharkiv on why zoning is necessary and what it should be filled with in the economic bloc in the first place.

Heterogeneity within the region

After visiting Kharkiv at the end of May, Volodymyr Zelenskyi made the following post on his social media pages: “2229 destroyed houses in Kharkiv and the region. We will restore everything, rebuild it, fill it with life ." At the same time, the President made it clear that cities should be independent in finding funds for reconstruction: “We need to find funds and credit lines. The state must provide this in terms of guarantees, and the leaders of cities and regions must find great projects and money."

However, it was later reported that the president's office was directly in charge of negotiations with Turkish and Polish investors interested in rebuilding Kharkiv, but Zelensky himself formulated his own vision of the role of local authorities in this process.

It is obvious that not only houses will have to be restored, but also the economy of the region, which has suffered great damage. The non-fulfillment of the regional budget by 30%, which was recently announced in an interview with the head of the regional administration Oleg Sinegubov, probably does not illustrate the full scale of the problem. There is currently no open information on the implementation of the budgets of the region's communities (in particular, the state of filling the Kharkiv budget remains unknown), but the situation is probably very complicated and, at the same time, heterogeneous, even within one region.

Currently, 30% of the region's territory is under occupation (more than 20 communities are fully or partially occupied). And if the reality divides 56 communities in the region into three conditional groups - "occupied", "frontline" with constant artillery shelling and "remote" from direct hostilities, the Ministry of Reintegration of the Temporarily Occupied Territories operates a different national classification . According to the ministerial order, there are currently two types of communities in Ukraine - " located in the area of hostilities or under temporary occupation or encirclement " and all others (relatively " ordinary ").

Source: https://decentralization.gov.ua/news/15041 .

This division allows migrants from the first type of community (ie both occupied and frontline) to receive assistance from the state, however, some other differentiation in economic matters is not yet affected.

It is interesting (especially for migrants from these settlements) that out of 56 communities in Kharkiv region, exactly 5 were identified, which the ministry considers "ordinary". All 5 communities belong to the Krasnograd enlarged district: but for some reason the Krasnograd city community is considered to be located "in the war zone", while territorially significantly closer to the front line Sakhnovshchyna or Kegychivska - "rear" (also "ordinary" communities include Natalinska, Zachepylivska and Starovirivska).

Discussion on a new regional policy

At the same time, the zoning announced by the authorities is planned to be more comprehensive and will address a number of economic and political issues. MP Vitaliy Bezgin was the first to write about such an initiative in his article " How the War Will Change Regional Policy in Ukraine: Decentralization, Communities, Taxes, and the Economy ." In particular, he reported on the joint position of the relevant parliamentary committee, the Ministry of Regional Development and the Association of Ukrainian Cities on the division into 4 types of territories :

(1) temporarily occupied territories;

(2) areas of hostilities;

(3) support areas (excluding hostilities, but those that are the first to provide assistance to regions with hostilities);

(4) rear areas.

According to the People's Deputy, the latter are the safest territories to which part of the population and business were evacuated. In these regions, for example, it is advisable to transfer the administration of local taxes to local governments. Bezgin offers certain preferences for the most affected areas, but in a subsidized sense : “We must provide preferences for areas where active hostilities have continued and where active reconstruction and restoration are needed. This means that some funds will be withdrawn from the budgets of the deep rear areas and will go as a basic subsidy to the weaker regions that have become vulnerable as a result of the war."

In essence, the people's deputy's proposal looks like an interpretation of the "horizontal equalization" mechanism that has been in place in recent years , when depending on the values of the tax index, "rich" communities gave a share of surplus income in the form of reverse subsidies and "poor" received a basic subsidy. In general, Bezgin's article is rather a framework - it contains more announced aspects that will change the "rules of the game" for different areas than the specific steps that should be expected.

Vice Speaker of the Parliament Oleksandr Kornienko also spoke about the special urgency of the idea of regional zoning in early May. "In areas where there is a more favorable economic climate, the investment climate can be said to be an incentive for business to be able to invest more. That is, we can talk about different approaches to the application of certain local taxes, because we are a unitary country, we can not let each region to form all taxes, but some additional opportunities can be discussed by local authorities.

Probably, such an approach will please business in the rear regions, although it looks contradictory: the principle of " money will go away from Russia " will work on its own and is unlikely to need to be strengthened by any other incentives. The (im)possibility of artillery shelling has already become a determining criterion for the investment attractiveness of territories - that is, the reality has already divided Ukraine into certain zones, and the key task of government is to find balance and restore economic capacity of liberated and frontline communities.

The politicized reference to the "unitary state" looks like an attempt to immediately block perhaps the most promising way to restore this balance due to different conditions of crediting national taxes to local budgets. But "unitarity" has nothing to do with this - it is not a question of the form of government. Unitarity does not prevent the fact that for Kyiv the enrollment of personal income tax (hereinafter - PIT) is 40%, and for other communities - 60%.

And it is even more significant that unitarity did not prevent September 30, 2021 in the framework of the Memorandum on the sustainable passage of the heating season in manual mode to make two changes to the state budget: first, send an additional 4% PIT to local budgets, and secondly state budget to communities outside the tax capacity index (up to 0.9). That is, there is a recent precedent that the share of PIT contributions to local budgets may increase , and that the state additionally selectively helps communities that are in the worst situation.

And at the end of a brief review of the discussion on the possible content of the idea of regional zoning should refer to the article " Paradigm of the border. How to properly structure territories and govern the country after the war " by ex-People's Deputy, Director of the Institute of Territorial Development Yuri Hanushchak.

It probably has the strongest view of regional policy from the standpoint of the interests of the rear areas . The general tone of the author's proposals is vividly illustrated by the following two quotations. " Western regions can still be seen as less vulnerable. That is where the population and movable property must be evacuated in the event of aggression. While areas that can be shelled by enemy long-range artillery, unfortunately, are potentially frontline. It is from these territories, based on the experience of the current war, that the evacuation of the population, including the total, must be carried out. < …>The state should not assume all the risks of force majeure of war in the case of placing business in a high risk area. In areas that are directly adjacent to the border and may be subject to mortar fire from enemy territory, it should be generally prohibited to place production facilities with high capitalization.

Despite the fact that "high-capacity production facilities" are often the target of missile strikes across (!) the country, Hanushchak is generously advising not to rebuild roads and infrastructure in the "risk zone", but in economic and in particular, tax equalization mechanisms says: “As for the tax benefits that will be provided to businesses located in high-risk areas, they should not distort market mechanisms, so the regulation of local taxes and fees should be preferred. But it is better to use regional development tools such as programs of the state fund for regional development . "

Translating these passages about "distortion of market mechanisms" and the need to limit the tax issue only to "local taxes and fees" into human language, we receive a proposal from Hanushchak, a native of Kolomyia, to restore liberated and frontline communities by raising tourist tax or tax rates on real estate. However, for example, from Kharkiv, where this property has been reduced by 2,000 completely or partially destroyed houses, and the tourist season this year has not worked out, a fair solution to this problem seems different.

PIT as a new tool for horizontal alignment

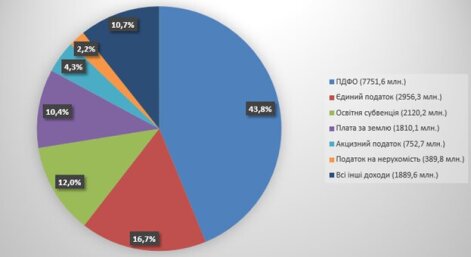

In the absence of open information on the state of filling the Kharkiv city budget in 2022, we still (in the experience of previous years) have an understanding of a more or less stable revenue structure - which is really significant and can help the frontline city close the budget hole. The chart below shows the data on city budget revenues in 2021. In total, they amounted to 17.3 billion hryvnias, of which 14.5 billion were own revenues and 2.8 billion were intergovernmental transfers (the lion's share of this amount is the educational subvention from the state budget).

Source: the chart is based on data from the report on the budget of the Kharkiv city territorial community for 2021

It should be reminded that directly by local taxes and fees the legislation determines:

- property tax (land tax and real estate tax);

- single tax (paid by business entities under the simplified taxation system);

- tourist tax;

- vehicle parking fee.

Proposals to close the "budget hole" at the expense of local taxes and fees, in fact, boil down to a recommendation to local authorities to raise the rates of relevant fiscal revenues, which seems simply an absurd increase in the tax burden on residents of war-affected areas.

But the most important source of the community budget's own income is the inclusion of 60% of PIT , which the legislation classifies as a " national " tax (another 15% goes to the regional budget, and 25% - to the state). This individual income tax alone gives the community budget more than all local taxes and fees combined.

Accordingly, the key instrument of "horizontal alignment" and the essential content of regional zoning should be the differentiation of PIT crediting to local budgets . The formula "60% + 15% + 25%", which is currently universal, should be different for each of the 4 regional zones. It would be adventurous to propose concrete formulas without careful and large-scale calculations based on up-to-date data on the state of implementation of all local budgets, but in the most radical version "recovery areas" (or budgets of 100% of own PIT.

It is important that, unlike the recommendations to do something with local taxes (between the lines of such proposals, in fact, contains the unpopular idea of raising rates along with shifting responsibility for this to local authorities), differentiation of PIT does not increase the tax burden on citizens - only the ratio changes credits between different local and state budgets.

It is clear that such an initiative will inevitably meet with resistance, because it is advantageous for some local leaders in the deep rear to leave everything as it is. For example, when the head of the Zakarpattia regional administration publicly promises IT specialists who will re-register in Zakarpattia to help "cut off" from mobilization - he is only interested in "washing out" the single tax from local budgets of the affected areas in his favor. He is also interested only in his own region, when Transcarpathia refuses to supply transit fuel from Europe to other regions until "the region's internal needs are met ."

And no matter how wild looting it may seem from Kharkiv, its logic is quite clear. It is natural that in conditions of limited resources, there are conflicts of interest, and the task of government - to find a fair balance. And in this context, I would like to see activity on the other hand - for example, legislative activity from people's deputies representing Kharkiv region (or their colleagues from regions with a similar situation).

In this parliamentary cadence, the Slobozhanshchyna inter-factional parliamentary association has traditionally been established, the main content of which is to defend the interests of the region's residents. Meanwhile, the future of the residents of Slobozhanshchyna depends more on the essential content of the "regional zoning" - which will eventually be spelled out and voted on - than on the entire "humanitarian" with whom the deputies are photographed combined. Either the government will promote the already spontaneous "washing out" of the region's economic potential and turn it into a subsidized "wild field", or create legislative tools to restore the balance and capabilities of the most war-affected areas.

Conclusions

The "zoning" that will be introduced by the authorities in the near future is a tool of regional policy that is quite adequate to the new Ukrainian reality. The main question is what will be its content in the political and economic blocs. Analyzing the expert discussion on these issues, we can see the identification of some threatening trends for the postwar future of the affected regions. In particular, the notion is established that all possible production facilities should be relocated, the population should be evacuated (preferably with further re-registration in the case of private entrepreneurs), it is impractical to invest in infrastructure reconstruction, etc. Regarding the filling of local budgets in frontline areas, it is proposed to limit the range of possible solutions exclusively to local taxes and fees, as well as the existing instrument of horizontal equalization through basic subsidies.

The problem is that in the pre-full-scale war, the horizontal leveling mechanism is designed to degrade the economic capacity of communities rather than the chasm between the deep rear and frontline or liberated settlements. In general, subsidies in themselves do not provide the necessary incentives to recover and restart economic activity - rather, it is a way to create long-term depressed regions. If we talk about the resources of the State Fund for Regional Development, their volume (a total of UAH 4.5 billion in 2021) is obviously too small. Just as local taxes and fees, which together in the structure of own revenues have less weight than PIT, cannot significantly affect the situation with filling the local budgets of the affected areas.

It is the differentiation of the percentage of PIT crediting to local budgets that seems to be a really powerful tool for horizontal equalization, adequate to the new realities. In addition, a precedent was set last year before the heating season, firstly, by changing the ratio of credits in favor of community budgets, and secondly, by supporting communities in the most difficult situations. Taking into account this important aspect of PIT should be reflected in the content of regional zoning. If the new state regional policy reveals other priorities, it is necessary to find the courage to inform citizens from the liberated territories and near the war zone. Recognize that the war for every meter of Ukrainian land is being waged without much hope of having anything worthwhile on this land, because the Russians will remain in the neighborhood,