After a 30-year high of consumer inflation in the US (6.2% in October, which is even higher than the NBU inflation corridor), a new shock: on November 19, the German statistics department reported that in October prices in the industry of the largest EU economy rose to a maximum in 70 years - 18.4% in annual terms. Against this background, the growth of industrial prices in Ukraine for 10 months by 51.5% was hardly noticed.

Industrial prices are not fully translated into consumer prices, but this is little consolation for us. There is a number of factors causing high inflation in the world for a long time. Which will certainly affect prices in Ukraine, which is integrated into the world economy and is highly dependent on the processes taking place in it.

1. Production factors.

- rupture of production and technological chains, due to which the shortage of goods and components increases. And the shortage of goods leads to an increase in their prices.

- energy crisis in the "assembly shop of the world" China. Power outages affect 20 provinces, and 16 have introduced rationed electricity consumption by industry. The investment bank ING believes that interruptions in the supply of goods from China will remain for a significant part of 2022. This will lead to higher prices for goods. As well as components, which will slow down the recovery of production around the world. That will give an impulse to the rise in prices.

- cost inflation due to the growth of world prices for raw materials (energy carriers, industrial metals, food, fertilizers, etc.), goods and components.

2. Structural factors.

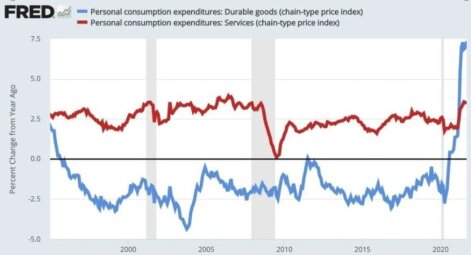

- pent-up pent-up demand that poured in after the weakening of COVID restrictions (increased demand leads to higher prices).

- a shift in demand from the service sector to goods, especially durable goods, leading to their rise in price.

3. Logistic factors.

Over the year, the cost of container transportation has almost tripled.

Title: The cost of container transportation worldwide

4. Monetary factors.

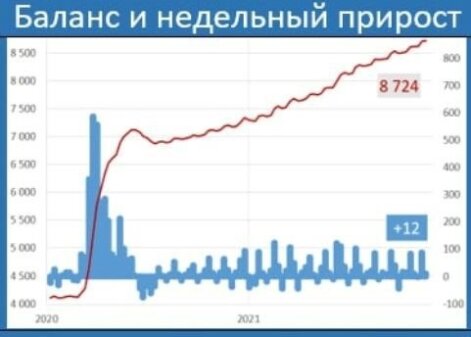

- in 2020 alone, the six leading central banks of the world (Fed, ECB, Central Banks of Australia, Great Britain, Switzerland and Japan) "threw in" 8.7 trillion dollars, which, unlike QE 2009-2014, did not go into the "financial contour", but spill out into the commodity markets.

- The Fed's balance sheet continues to grow, and there is more money in the economy of the United States and other countries where it flows from the Fed. Taking into account the reduction in production, this is a pro-inflationary factor.

Title: Balance and weekly growth

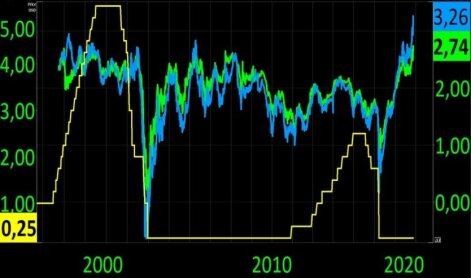

- As the head of the Federal Reserve Bank of Chicago Ch. Evans said, the curtailment of emergency stimulus will not be earlier than the second half of 2022, and the FRS rate can be raised only after that .

- low rates of key central banks, which will not be significantly increased - otherwise, servicing the sharply increased public debt will become much more expensive. And the increase in rates will not contribute to the growth of production, which the Fed and the ECB understand.

5. "Labor".

The demand for labor in the United States is high, but there are problems on the supply side - many are content with benefits and part-time jobs. Businesses are experiencing difficulties in recruiting personnel, which leads to growth in salaries, which in October increased by 4.9% on an annualized basis.

6. Medical.

- an increase in the incidence of coronavirus - at the beginning of the third decade of November, the maximums were updated in Germany, the largest economy in Europe, Austria, the Netherlands, Finland, the Czech Republic, Slovakia, Croatia, in several states the number of people infected per day is close to records. This leads to new lockdowns (Austria has already introduced a nationwide lockdown from November 22nd).

- the expected increase in the incidence in the spring (coronavirus is seasonal).

7. Psychological.

Growth of inflationary expectations, and not only among the population. The growing difference between the yield on inflation-protected bonds and the yield on US government bonds indicates that market participants believe in high inflation. This belief determines the actions of market players, who in their strategies proceed from the expectation of price increases.

The Fed and the ECB still consider inflation to be temporary. They are echoed by the November survey of managers from Bank of America - 61% of respondents consider temporary inflation. It is difficult to argue with the authorities, but of the seven factors in favor of not increasing inflation, only a slight decrease (by 10%) in the cost of transportation in October-November can speak, which may be a purely ad hoc phenomenon. However, “temporarily” is an individually understood concept.

The above factors indicate that global inflation will be high for at least the entire next year. What the head of the SEC K. Lagarde indirectly admitted, saying that the surge in inflation will be higher and longer than previously assumed, there is no clarity about the duration of the supply restrictions, they can gradually weaken only during 2022.

All this will directly affect prices in Ukraine. The National Bank's forecast that inflation will return to the NBU's target of 5% ± 1% in 2022 is most likely overly optimistic. We need to prepare for the fact that prices will rise noticeably over the next year.

The world is faced with an extraordinary situation. The central banks and the Ministries of Finance of the leading countries of the world have not yet found any acceptable way out of it. Long-term rise in inflation is worrying. But it will be worse if it turns into hyperinflation or stagflation ...